8+ Donation Tax Deduction Calculator

Web Make a fully tax deductible contribution and give at your discretion for many years to come. Web Calculate savings Important information Contributing securities directly to Fidelity Charitable could mean reduced taxes for you and more dollars for the causes you support.

Tax Credits Charitable Deductions And More End Of 2021 Tax Tips Cbs8 Com

The form is required if you are donating computers and other technology equipment so.

. 1000 1200 2200 2400 3200 3500 3700. For donations exceeding 250 obtain a written acknowledgment. To determine the fair market value of.

Web During the pandemic Congress temporarily expanded tax deductions for very large and very small charitable donations but these changes expired at the end of 2021. 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan. If a person chooses 5.

Bank statements or receipts suffice for most contributions. Web 1 200 50 Price 1000 - 2000 Fair Market Value Below is a donation value guide of what items generally sell for at Goodwill locations. Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they dont.

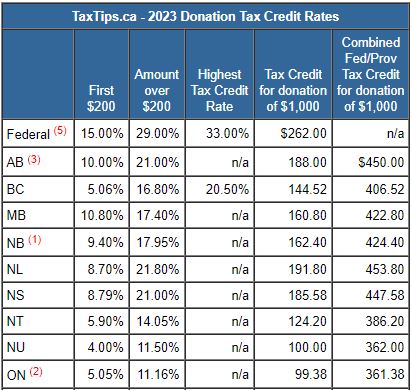

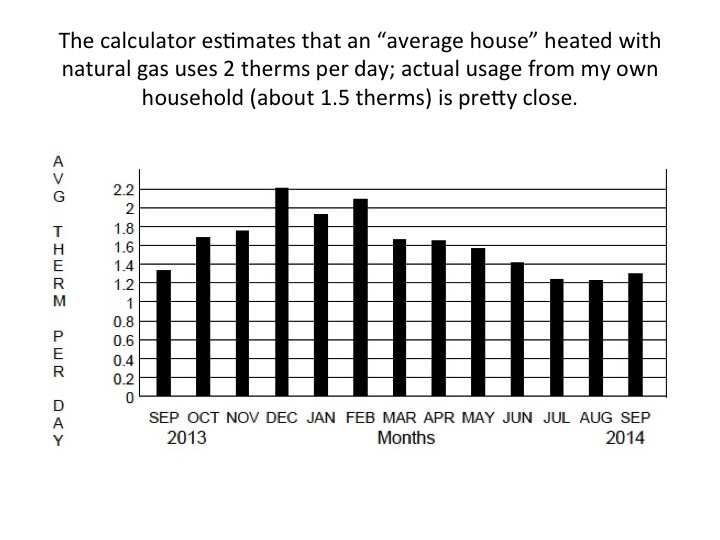

Web This calculator determines how much you could save based on your donation and place of residence. Web Charitable Tax Deduction Calculator When a person makes a charitable donation that donation can be deducted from the individuals income. Enter the donation amount in the box below and press the Calculate button.

But tighter restrictions can apply for some donations and. Web Click this link to get started. Web Resident taxpayers subject to the tax may deduct the amount of their charitable donations in excess of 250000 annually subject to an annual limit of 100000.

The Donation Tax Value Calculator is a handy tool for individuals who make charitable contributions and want to estimate the tax deduction. Web Typically the most you can write off for donations is 60 percent of your adjusted gross income AGI. MORE ABOUT THE FUNDS Benefits of giving through the US.

Web When you bring items to one of our donation locations you may fill out a paper form there. Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching. Web Cash Donations.

29 2024 as the official start date of the nations 2024 tax season when. Web A typical amount for many donors is 5. You may be surprised to learn that you can afford to be even more generous than you thought.

What is your top marginal tax rate. Web The calculator will display the net cost of the donation and the tax savings. This will reduce taxes in the tax.

Web Also remember the income tax deduction received from the gift to the charitable trust will be in direct proportion to the percentage withdrawal rate chosen. Web Charitable Giving Tax Savings Calculator. If you choose to make a.

Four Ways To Maximize Charitable Giving Impact In 2021 Schwab Charitable Donor Advised Fund Schwab Charitable

![]()

Schwab Charitable Tax Calculator

2023 Donation Tax Credit Rates Taxtips Ca

8 Year End Charitable Giving Strategies Schwab Charitable Donor Advised Fund Schwab Charitable

All I Got For Christmas Was The Washington State Carbon Tax Swap Calculator Sightline Institute

7 Tax Receipt Templates Doc Pdf

8 Sample School Charity Proposal In Pdf

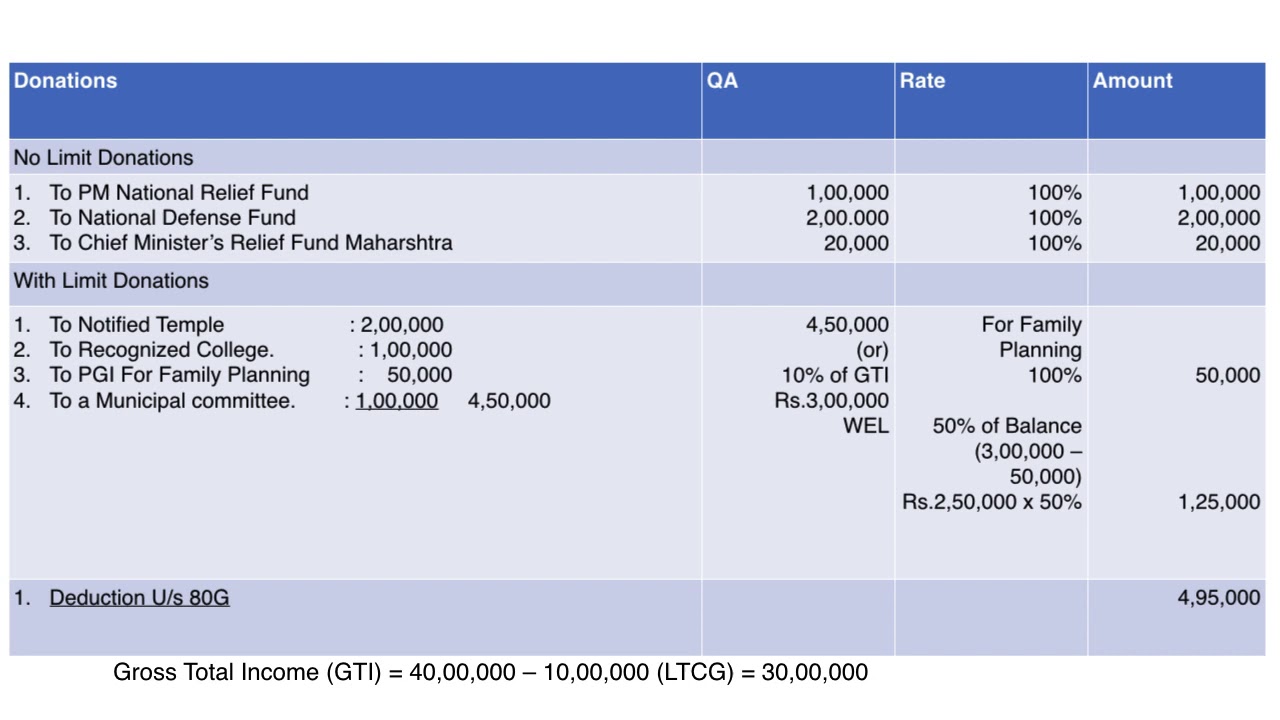

Calculation Of Deduction U S 80g Youtube

What Is The Best Way To Save Income From Tax Quora

Crypto Donations How To Reduce Taxes Coinledger

Charitable Donations Tax Credits Calculator Canadahelps

Super Deduction Calculator For Storage Purchases

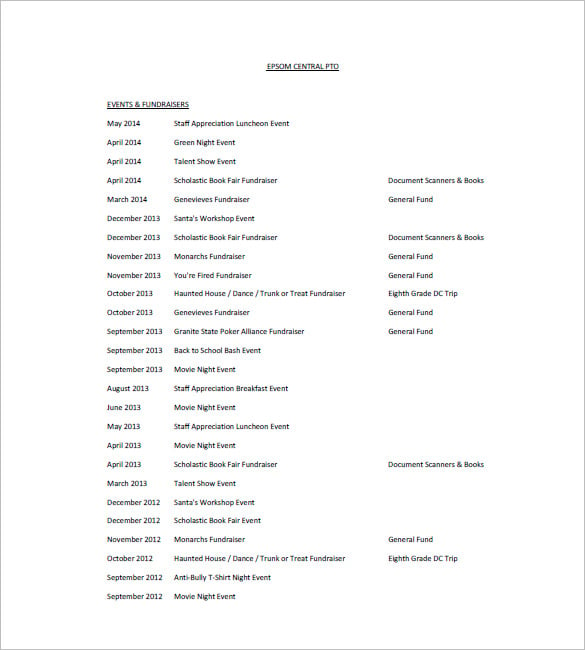

Donation List Template 8 Free Sample Example Format Download

Tax Calculator Smartgiving

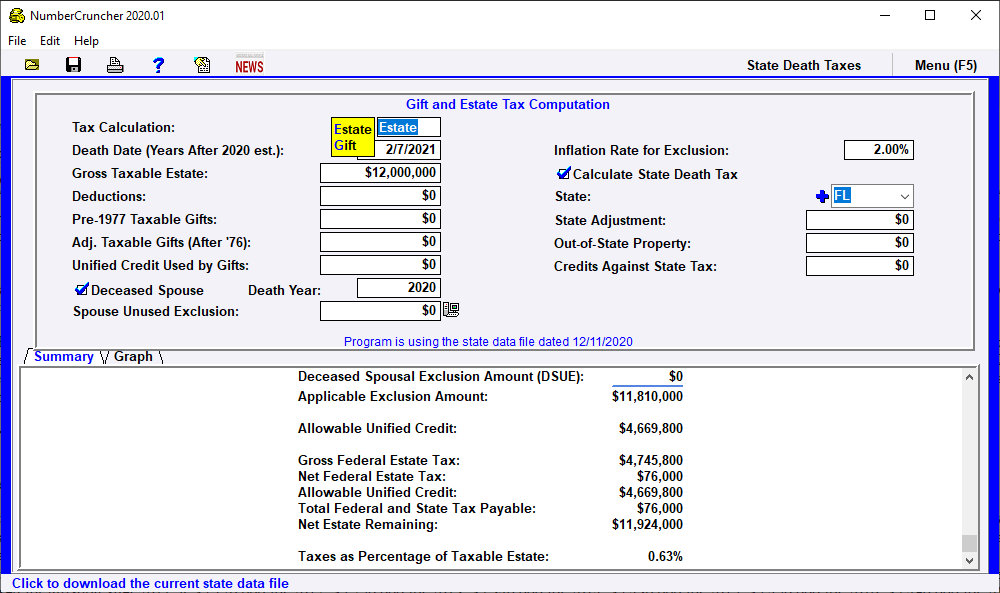

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

Financial Opportunity Center Goodwill

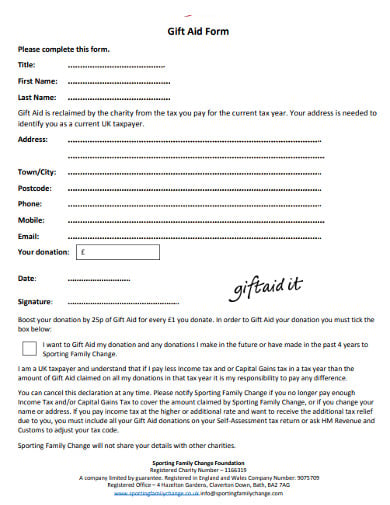

10 Charity Gift Aid Form Templates In Pdf Doc